Mobile banking

Get everything you need at Belagroprombank

- Block, reissue, set limits

- Check your balance and transaction history in one click

- Open deposits and accounts, order new cards, submit applications for loans without visiting a branch

- Housing and communal services, internet, mobile communications and other services through SSIS – no commission

- Fast payments using QR code

- By card or phone number

- Between your accounts - instantly

- Create goals in the MoneyBox

- Postpone automatically or manually

A personal approach in every touch

-

Add frequent operations to the Quick Access section.

-

Connect bonus programs, push notifications, and auto payments.

-

Personalize your profile.

-

Choose from a classic light or stylish dark theme.

-

Confirm payment and login to the app using biometrics.

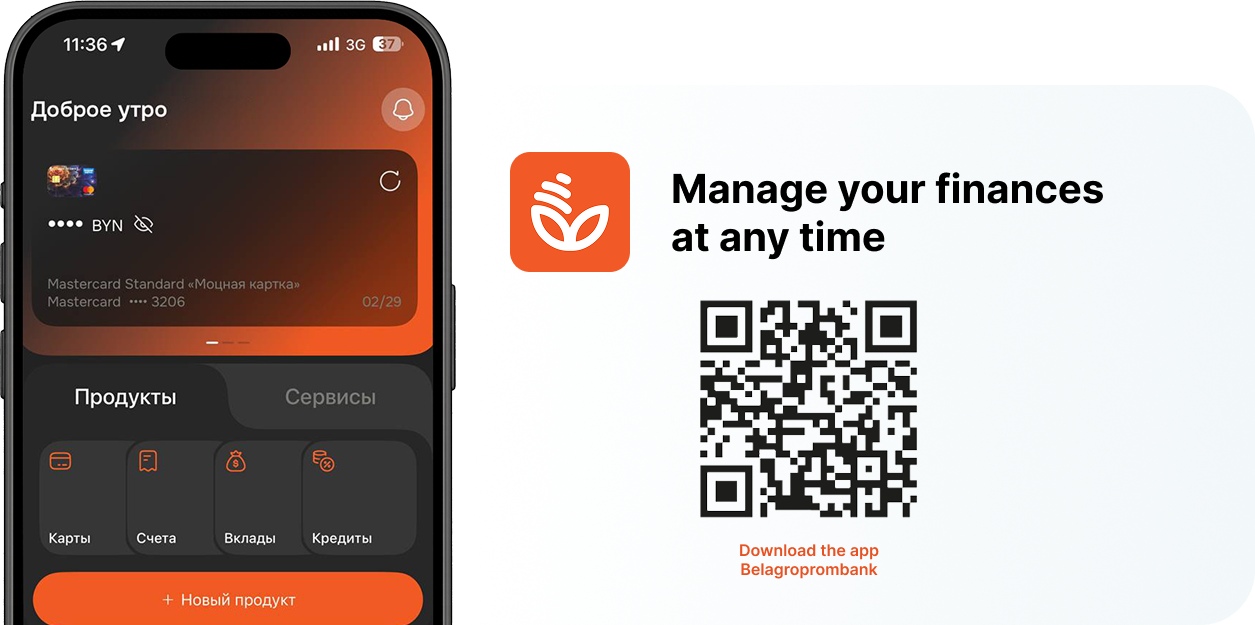

Install the Belagroprombank application

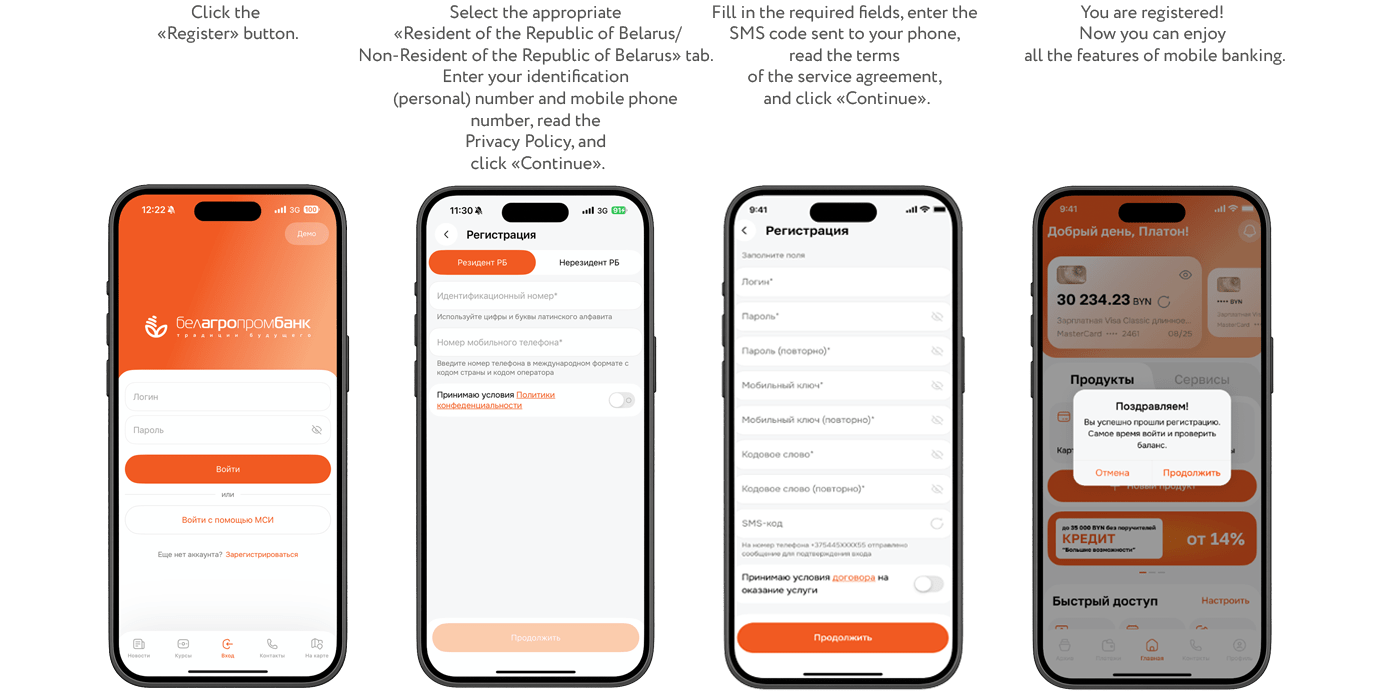

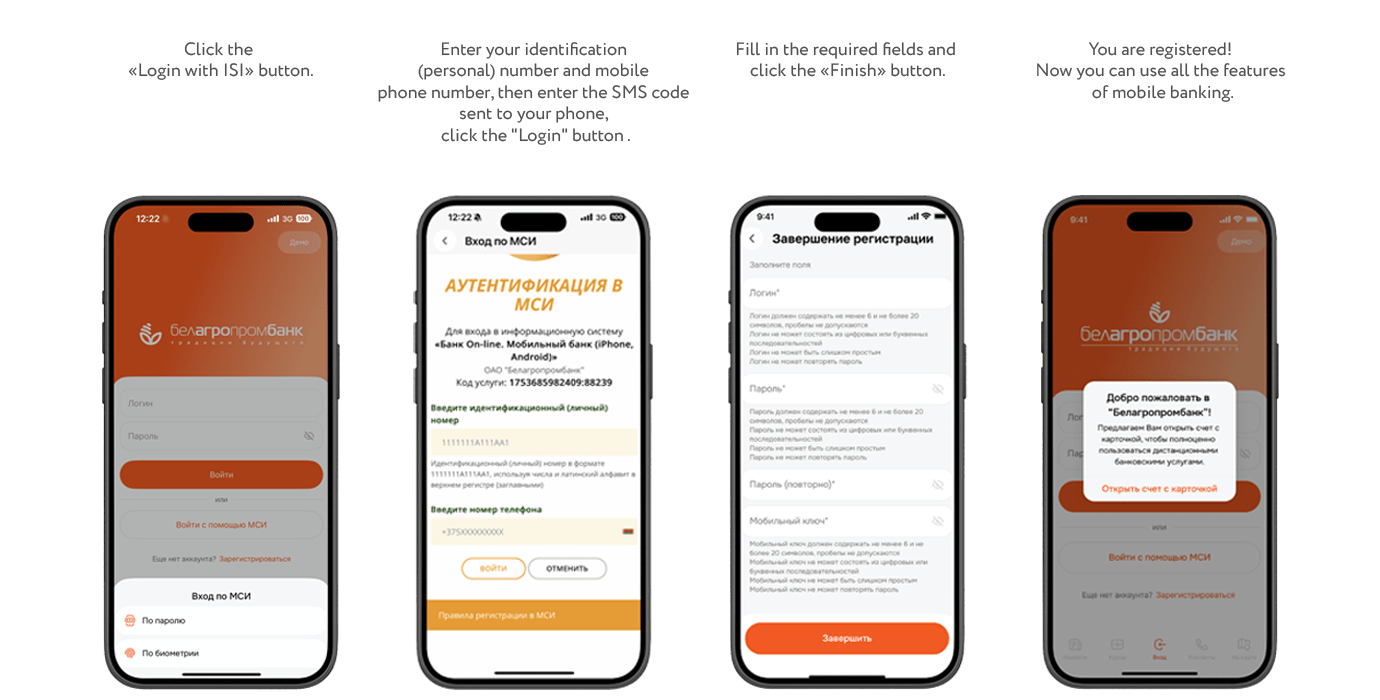

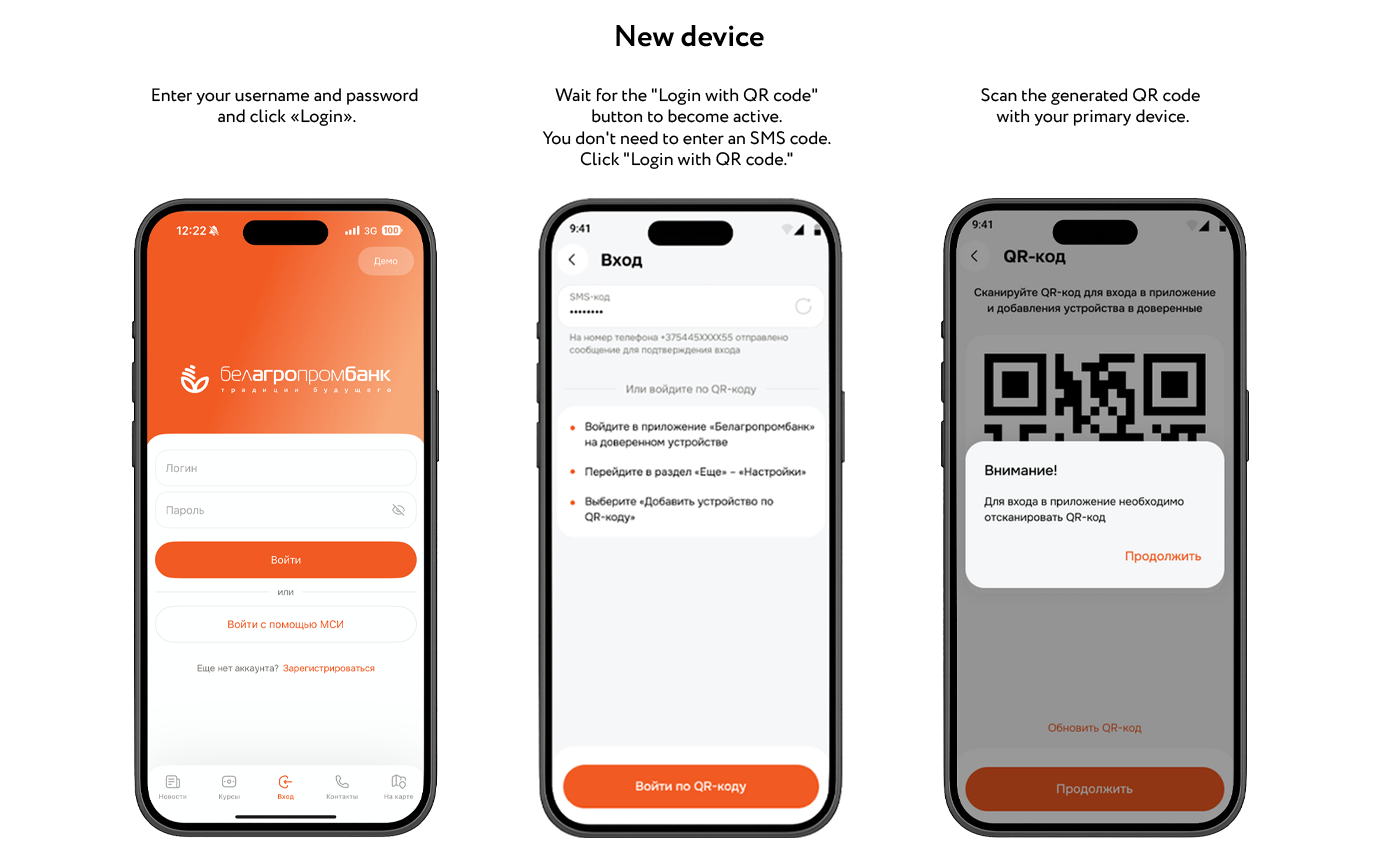

How to register for Mobile Internet Banking

Answer: The minimum operating system version supported by the mobile app must be at least 8 for Android devices and at least 14 for iOS devices.

Answer. These are pop-up messages in the mobile app that inform about write-offs, credits and transactions on bank cards in in real time. Notifications are saved in the "Profile" section.

Push Notifications" → " Push Notifications" and allow you to quickly track the movement of funds.

Answer. Push notifications are activated automatically when connected any "SMS-informing" package, which are located in the "Cards" section.

Answer. Push notifications are sent to all devices where the Mobile banking is installed and you are logged into your account. You will receive a notification simultaneously on each active device.

Answer. PIN code is a secret five-digit code for access exclusively to the mobile application that you specify when you first log in Mobile app. The PIN code is used for subsequent logins.

Mobile application.

If your device supports the ability to use biometric data (Touch ID, Face ID functions), you can use them the second and subsequent times you log in to the Mobile Application.

In the "Profile" - "Settings" section of the mobile application you can set a convenient authentication method for you when logging into the Mobile Application:

"Login and password" or "PIN code". When selecting as a method PIN authentication You can choose to log in using Touch ID/Face ID (fingerprint)

Answer. Login is the username used to log into the mobile application and/or internet banking.

Password – a secret access code to the mobile application and (or) the Internet banking, other than the established mobile key or PIN code .

You set your login and password yourself when you pass registration procedures or they are given to you when you connect the service Internet banking at a bank branch.

A mobile key is a reusable secret code that is used to confirm your consent to perform transactions using a mobile application. The mobile key is installed automatically when registration in the mobile application or in the “Profile” - “Settings” section, as well as is installed in Internet banking through the “Service” section - “New mobile key."

Login, password and mobile key used when working on the Internet banking, mobile application should contain from eight to twenty symbols, and numbers, uppercase and lowercase letters must be used.

Answer. Forgotten mobile key recovery is not possible.

You can set up a new mobile key in one of the following ways:

- In Internet banking you need to go to your personal account, select section "Service" / " New mobile key".

- You must re-register in the Mobile App. To do this, on the PIN entry screen when logging in to the app, tap Forgot your code?" or the "Logout" / "Change user" icon. Then, select "Register" and enter the following information:

- identification (personal) passport number/passport number,

- phone number,

- after that, select “I don’t remember my login or password”,

- confirm your phone number,

- assign a new login, password and mobile key.

When creating a new mobile key, at least 2 characters must change compared to the previously installed mobile key.

Answer. For the safety of mobile app users when three times incorrect login/password entry, PIN code account blocked for 2 hours (after 2 hours it is automatically unblocked).

Answer. To restore access to the mobile app, you can re-register in the mobile app.

To do this, on the PIN entry screen when logging into the app, tap "Forgot your code?" or the "Logout" / "Change user" icon. Next, select "Register" and enter the following information:

- identification (personal) passport number/passport number,

- phone number, then select “I don’t remember my login or password”,

- confirm your phone number,

- assign a new login,

- password and new mobile key.

When creating a new login, password, and mobile key, at least 2 characters must change compared to the previously set login/password/mobile key.

Please note! When changing your login information (login and password) In the mobile app, the login details for online banking will change automatically.

Answer. For devices on the Android operating system.

To activate automatic substitution of confirmation codes from SMS messages on devices with the Android operating system , you need to go to section «Settings» / «Google» / «Autofill» / «Verification codes from SMS» and toggle the switch "Automatically enter verification codes from SMS» to active state.

Huawei devices.

To activate automatic substitution of confirmation codes from SMS messages on Huawei devices, you need to allow «Huawei Core» access to SMS-messages. To do this, go to the «Settings» section. «Apps & notifications» / «Apps» / «HMS Core» / open the «About» menu

application» and click «Rights». Without granting this access, auto-substitution may not work. correctly.

For devices running the iOS operating system.

To activate automatic substitution of confirmation codes from SMS messages on the iOS operating system there are no additional settings required, click on the «SMS code» field, and when the SMS message arrives, then in

A code will appear in the «hint» above the keyboard that you need to press

to perform auto-substitution .

On iOS 15.0 and higher, the code from the SMS message is entered manually in the «SMS code» field.

Answer. We recommend using one or more of the following recommendations, which may help in this situation:

- turn on and off «Airplane mode»;

- completely reboot the device;

- remove and reinstall the SIM card;

- reset network settings;

- contact your mobile operator.

Answer. The Belagroprombank app may not work abroad via some Wi-Fi hotspots . We recommend changing the Wi-fi hotspot and try again.

Answer. You can create a mobile key directly in the mobile application in in the “Profile” – “Settings” – “Mobile Key Management” section, and also in in the Internet banking section “Service” – “New mobile key”.

Answer. To clarify the reason for the blocking and its removal (if any), we recommend contacting the Contact Center or a bank branch..

Answer. On the PIN entry screen when logging into the application, you must Click on “Forgot your code?” or the “Logout” / “Change user” icon. Then you need to enter your login and password, set a new PIN code.

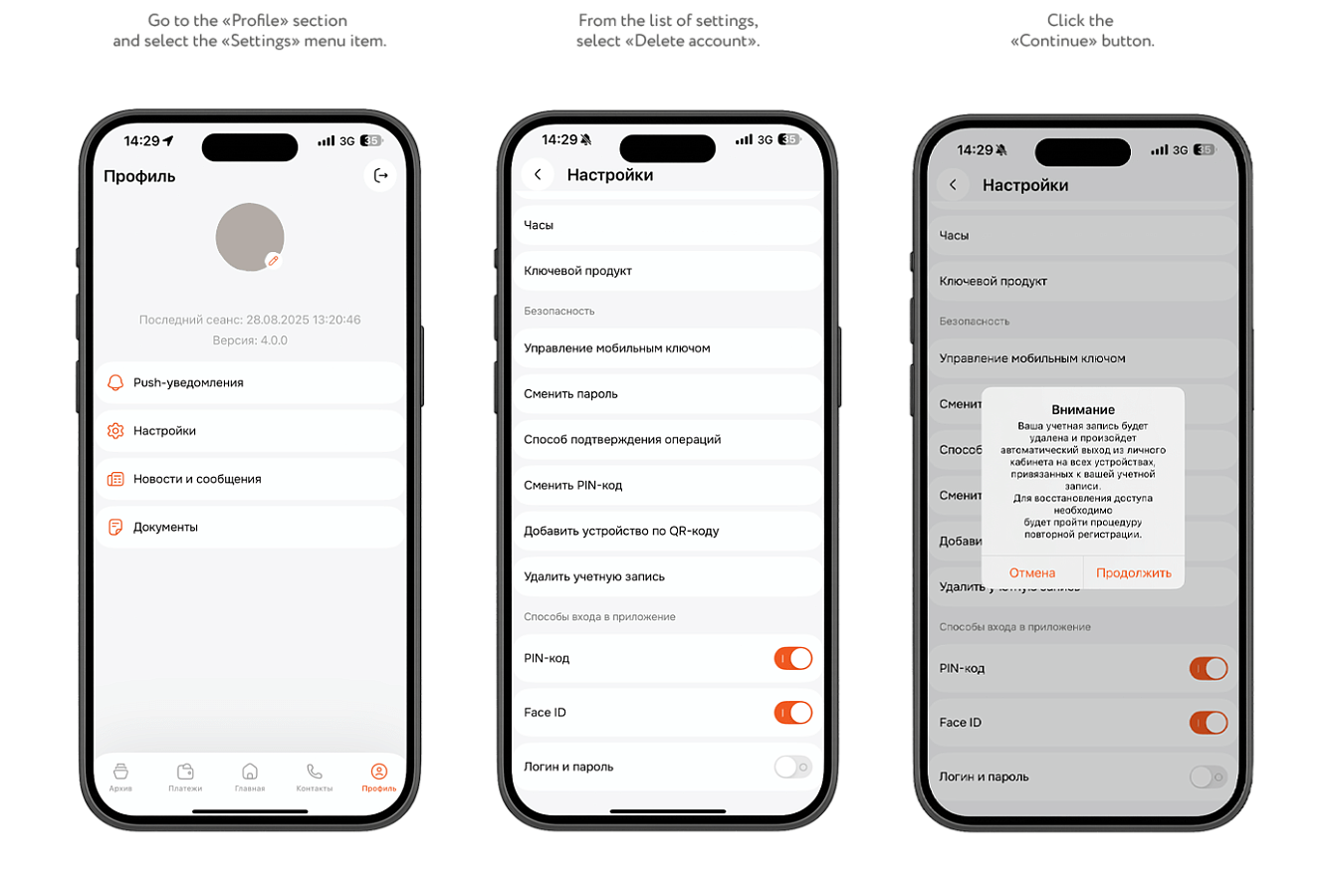

Go to the "Profile" section and select the "Settings" menu item. From the list of settings, select "Delete account." Click the "Continue" button.

After completing the actions indicated in the templates, your Mobile Internet Banking credentials will be deleted.

To regain access to your account, you need to go through the registration procedure again.

Issues related to the storage of user data are governed by the Bank's internal regulations, as well as the Law of the Republic of Belarus dated 07.05.2021 No. 99-3 "On the Protection of Personal Data" and other legislative acts.